Newsletter – January 2023

Click here to view and download the newsletter in its original format.

Happy New Year to all, and hopefully it will be a prosperous one that will see reductions in interest rates, inflation, and general costs for Irish business. As we face a New Year, here are some things to consider and note.

Paid Sick Leave is Now Mandatory

The Sick Leave Act 2022 is now approved, and came in to force from 1st January. For 2023, the entitlement is for 3 days, increasing to 5 in 2024, 7 in 2025, and then 10 in 2026. The rate of pay is 70% of an employee’s wage, up to a maximum of €110 per day. In order to qualify, an employee must have worked for the employer for a minimum of 13 weeks, and the employee is obliged to obtain a medical certificate. An employer may opt to pay more beneficial terms to an employee if they wish.

Do Your 2022 Income Tax Return Now if You Suspect You Are Due a Refund

As we mentioned in our December newsletter, there is no reason to wait until October to do your 2022 income tax return – we can submit it now and get you a refund if you are due one. Please contact us to discuss this if you suspect you are entitled to a refund.

Consider Starting to Repay Warehoused Tax Liabilities

While you can wait until April 2024 in some cases to begin paying these back, why not start paying off some now if you can afford it? This will ease the burden and make the monthly amount in the future more manageable. In our experience, it could also lead the Revenue to treating you more favourably when you do seek to enter into a formal agreement next year to repay these liabilities.

Have You Made a Capital Gain in December 2022?

If you are fortunate enough to have made a capital gain in this period, the deadline to pay any tax due is 31st January to avoid penalties. If this applies to you, please contact us as soon as possible to allow us calculate your liability.

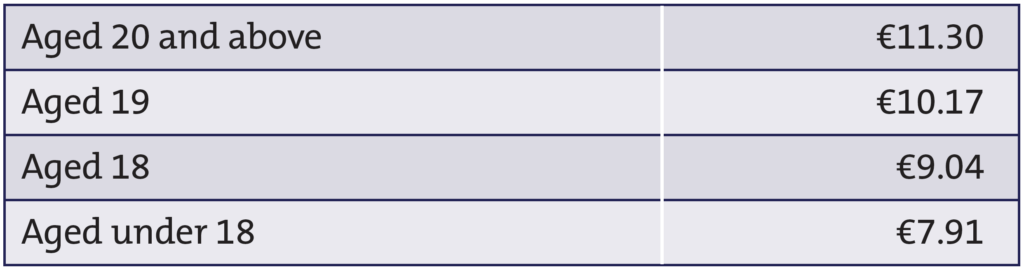

Increase in the Minimum Wage

The National Minimum Wage will increase from 1st January 2023 as per the table below:

The following are excluded from the national minimum wage:

- Employees who are close relatives of the employer, if the employer is a sole trader.

- A craft apprentice within the meaning of the Industrial Training Act 1967 or the Labour Services Act 1987.

National Childcare Scheme

In the budget for 2023, the Minister for Finance introduced the National Childcare Scheme. This is to help working parents with the cost of childcare from 1st January 2023.

The scheme is not means tested so is available to all. It is worth €1.40 per hour of childcare up to a maximum of 45 hours per week. You must apply for the scheme at www.ncs.gov.ie.

The rebate will be issued to the childcare provider who should then reduce the monthly fee charged to the parent.

Please note one of our staff members has applied for the scheme and it seems that it can not be backdated so it is important to apply ASAP.