Newsletter – January 2022

Click here to view and download the newsletter in its original format.

Good morning, and Happy New Year. I hope you were able to enjoy Christmas and re-charge the batteries, and are ready to face 2022 with enthusiasm. I am optimistic that COVID will cease to rule our lives shortly, albeit it will continue to curtail life in some ways for the next number of months.

EWSS

Due to the continued presence of COVID, the EWSS scheme has been extended – please read the criteria below to see if you can now qualify for this support.

The comparison period for businesses in existence before May 2019 is December 2019 turnover + January 2020 turnover compared to December 2021 actual turnover + January 2022 projected turnover. There should be a 30% or more reduction in turnover to be eligible for re-entry to the scheme.

Once an employer has determined they are eligible to re-enter the scheme, the template at Appendix I for businesses in operation on 30 April 2019 or Appendix II for businesses which commenced operation on or after 1 May 2019, should be completed and submitted to Revenue by 15 January 2022 through My Enquiries, selecting ‘Employer’s PAYE’ and then ‘Employer’s PAYE General Enquiry’.

Revenue will then undertake a review of the submission and ensure the business, if eligible, is registered. A notification will issue through My Enquiries to the employer advising of the outcome of the re-registration request.

If re-registered, this will be effective from 1 January 2022. Employers should ensure a claim is submitted in respect of all eligible employees for pay dates between 1 January and 30 April 2022. If payroll has been submitted prior to re-registration without including an EWSS claim, this should be amended to include the EWSS claim after receipt of the successful re-registration confirmation.

Please refer to the following link for more information including eligibility criteria and the template required for re-entering the scheme: https://www.revenue.ie/en/employing-people/documents/ewss/ewss-guidelines.pdf

Debt Warehousing Comes to an End

Due to the impact of COVID, businesses were able to defer payments of all PAYE, VAT and income tax for any liability up to 31 December 2021. This facility has now ceased.

If you have warehoused any taxes, it is a condition of the scheme that you must file AND PAY all ongoing tax liabilities as they fall due. If you do not, Revenue may withdraw the debt warehousing facility and seek immediate repayment of all taxes. For a number of our clients, this will be an onerous task. Please contact us if you are concerned and need any assistance with this matter.

Benefits of Switching to Cloud-based Accounting Packages and Apps

2021 saw a huge improvement in the quality and affordability of cloud-based packages. Here are some benefits of adopting this new technology.

- The ability to create and send an invoice in real-time from any device – mobile phone, iPad, PC. So let’s say you are out with a customer looking for payment and they say “I never received your invoice or send me a statement” – you can literally access it and send it from your phone instantly.

- We as your accountant can access your data remotely also. So if you have a question, we can access your figures and discuss them while looking at the up-to-date information.

- There are several apps now available that facilitate importing your bank account, credit card or payments gateway, such as Elevon, directly into the accounts package. This saves a huge amount of time and eliminates errors.

- We now use DEXT which allows the direct entry of supplier invoices in to the accounts package. For clients with high volume of purchase invoices, this saves a lot of time. Once the invoice is then entered on to the accounts package, a PDF of it is stored electronically and therefore you are no longer required to retain paper files, thus saving storage space.

- You pay a monthly subscription for a cloud-based package with prices varying from as little as €15 per month and up to €40 per month for versions with additional features. This includes all updates free and instantly, plus the package is backed up remotely. We can assist you with your decision in choosing the package suitable for your requirements.

It’s a New Year So Here’s a Few Ideas of Resolutions You Can Adopt to Save You Money

1. Mileage and Subsistence Rates

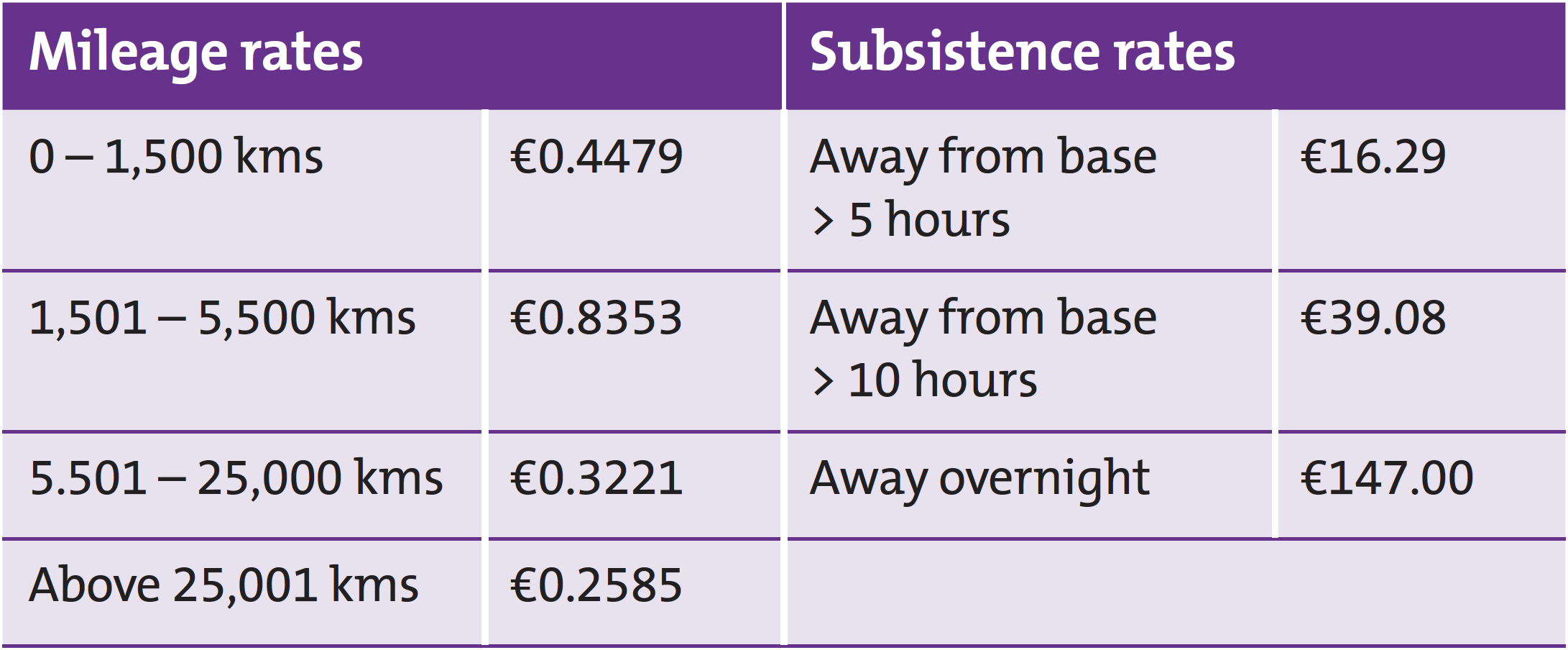

We noticed while preparing accounts late last year, a number of clients were using old mileage and/or subsistence rates. The rates have actually increased so it is to your advantage to adopt these correct rates. Also remember that at the start of each year, you must start with the lower rate per km until you exceed 1,500 kms. The current rates are:

Remember, to claim mileage and subsistence it is as simple as recording your journeys on a spreadsheet, no receipts are needed, and the payments are tax-free. If you are not availing of either of these payments, please contact us to discuss and we can send you a spreadsheet to record your travels.

2. Cancel Any Unneeded Subscriptions, Both Business and Personal

Many clients sign up for various publications, software tools, online training, etc. that they may have needed at a particular time. Review these services and see if you still need them. If you don’t, cancel them.

3. Watch Out for the End of a Lease or PCP Agreement

Many clients use leasing or PCP to purchases vehicles or equipment. When the primary payment period finishes, you need to take action. To become the owner, and cease all future payments, frequently you just need to contact the leasing company and tell them, and they will send you a form to sign. However, some leasing companies have a sneaky clause, that if you do not complete the cessation form, they may continue to take payments, or lesser payments forever. Please review your lease agreements and schedules to check this. The worst offender in this regard is a leasing company that begins with the letter “G” – that’s all I’ll say. PCPs have multiple options, but again prepare in advance of the termination date and know what is best for your circumstances.

4. Review Your Life Assurance, Permanent Health Insurance (PHI) and Health Insurance

Life insurance premiums in general continue to fall. Your broker should be able to get you a reduced premium for the same level of cover, or get you increased cover for the same premium. In relation to PHI, it is critical that you inform your provider of any changes in your salary. If your salary has reduced, you may be paying too high a premium, AND you will get a reduced claim, or if it has increased, you may not be adequately covered.

In relation to Health insurance such as VHI, it is worth shopping around as you can often save a significant amount of money by merely changing to a different plan provided by your existing company, or changing provider. A client, JD Moneysave, offers a free comparative service to anyone. Please contact James Durkan at [email protected] or 087 950 8795.

For pensions and investments, getting the investment strategy right is the most important task to help ensure good outcomes. Everyone has their own set of unique circumstances and challenges and our preferred financial management provider, DFP Pension & Investment Consultants, take the time to understand your situation and then deliver clear recommendations to help you achieve your shorter-term priorities and long-term goals. DFP have full access to all investment platforms and life assurance company providers here in Ireland. Please contact us if you would like an introduction.